Malaysia’s Employees Provident Fund (EPF) has turned in one of its strongest half-year performances in recent memory, putting it on track to deliver a healthy dividend for 2025.

Image credits: Malay Mail

Just weeks after facing parliamentary questions over a 13% dip in 1Q2025 investment income, the fund bounced back in the second quarter, with results that analysts say all but guarantee a dividend of at least 5.5%, with a 6% payout still on the table.

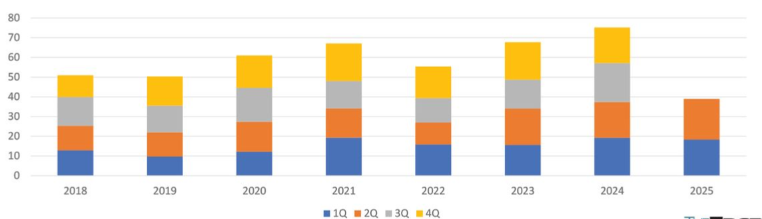

First-half results at a glance

- Total investment income (1H2025): RM38.92 billion (+3% y-o-y)

- Unrealised forex gains (non-distributable): RM0.44 billion

- Distributable income (1H2025): RM38.48 billion

- 2Q2025 income: RM20.61 billion (+22% y-o-y)

- Gross contributions (2Q2025): RM31.32 billion, about RM4 billion higher than 2Q2024

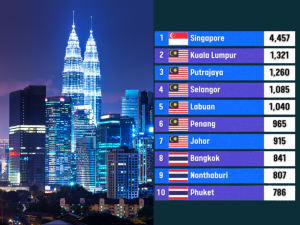

- Fund size (end-June 2025): RM1.31 trillion, on track to hit RM2 trillion by 2030

Image credits: The Edge

Dividend outlook

Analysts from The Edge say EPF’s first-half distributable income alone could cover around a 3% dividend. With steady performance in the second half of the year, a full-year payout above 5.5% looks very likely.

Hitting 6% remains possible, but matching last year’s 6.3% dividend is a taller order. The fund would need to outperform its latest quarterly results in the months ahead.

Image credits: The Edge

Bigger fund, bigger challenge

EPF’s rapid growth is both a strength and a hurdle. While contributions remain strong, driven by steady employment and higher wages, the larger fund size also means it takes more earnings to sustain high dividend rates.

For context, the RM48.13 billion income that delivered a 6.9% dividend back in 2017 would barely cover just above 4% today.

Image credits: Canva

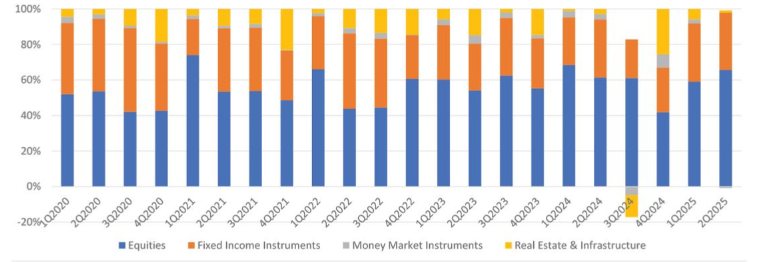

Where the income came from

- Equities: RM13.77 billion (66.8% of 2Q2025 income)

- Fixed income: RM6.73 billion (33%)

- Real estate & infrastructure: RM0.29 billion (1.4%)

- Foreign assets: 39% of total assets but contributed 63% (RM12.92 billion) of income in 2Q2025

EPF CEO Ahmad Zulqarnain Onn credited the strong showing to “steady market recovery, strong domestic contributions and disciplined portfolio management,” while stressing that the fund remains cautious given global uncertainties like trade tensions, inflationary pressures, and shifting geopolitics.

After a shaky start to the year, EPF has regained momentum. A 5.5% dividend looks comfortably within reach for 2025, while a 6% payout isn’t off the table, though topping last year’s 6.3% may be a stretch. In order to reach 6.3%, EPF needs to generate an even higher income just to maintain dividend levels. So, while a repeat of 6.3% looks tough, members can still expect a strong showing for 2025.

Follow Wah Piang for more.