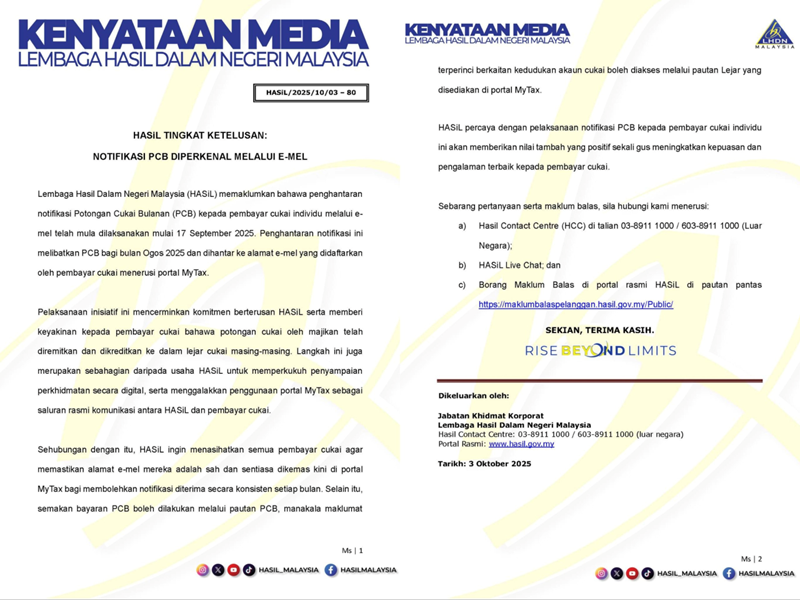

The Inland Revenue Board of Malaysia (LHDN) has officially commenced emailing the monthly tax deduction (MTD/PCB) updates directly to individual taxpayers, effective 17 September 2025. LHDN issued an official announcement regarding this initiative today, reaffirming its ongoing commitment in enhancing digital service delivery, promoting greater transparency in tax administration.

Image credit: LHDNM (Facebook)

Reassuring taxpayers through timely updates

LHDN has begun distributing notifications for the August 2025 deductions to taxpayers who have registered valid email addresses through the MyTax portal. According to LHDN, this initiative aims to provide taxpayers with assurance that the tax deductions made by employers have been accurately processed and credited to their personal tax accounts, helping to reduce uncertainty and build confidence in the system.

Strengthening the role of MyTax portal

Image credit: LHDN

This initiative is part of LHDN’s broader strategy to establish the MyTax portal as the official platform for all communication between taxpayers and the board. Taxpayers are strongly encouraged to ensure their email information up to date on the portal to ensure the uninterrupted receipt of these monthly notifications.

Taxpayers seeking additional information can find detailed records of their monthly tax deductions within the dedicated MTD section on the MyTax portal. A comprehensive overview of their tax accounts is also available through the portal’s “Ledger” function. These features can be conveniently accessed on the go via MyTax mobile application, compatible with both Android and iOS devices.

Through this initiative of sending monthly email notifications, LHDN strives to streamline communication channels, enhance accessibility for taxpayers, and reinforce public confidence in the Malaysia’s tax system.

Follow Wah Piang for more updates.