With Malaysians living well past 75 on average, more people are taking retirement savings seriously and it shows in their Employees Provident Fund (EPF) accounts. Reports by Malay Mail that voluntary top-ups and contributions beyond the mandatory rate have been steadily climbing. The trend signals that members are becoming more proactive about securing their golden years.

Older members saving more

Among members aged 51 to 55, 42% have now hit the “Basic Savings” level for their age, which is a slight jump from just 36% two years ago.

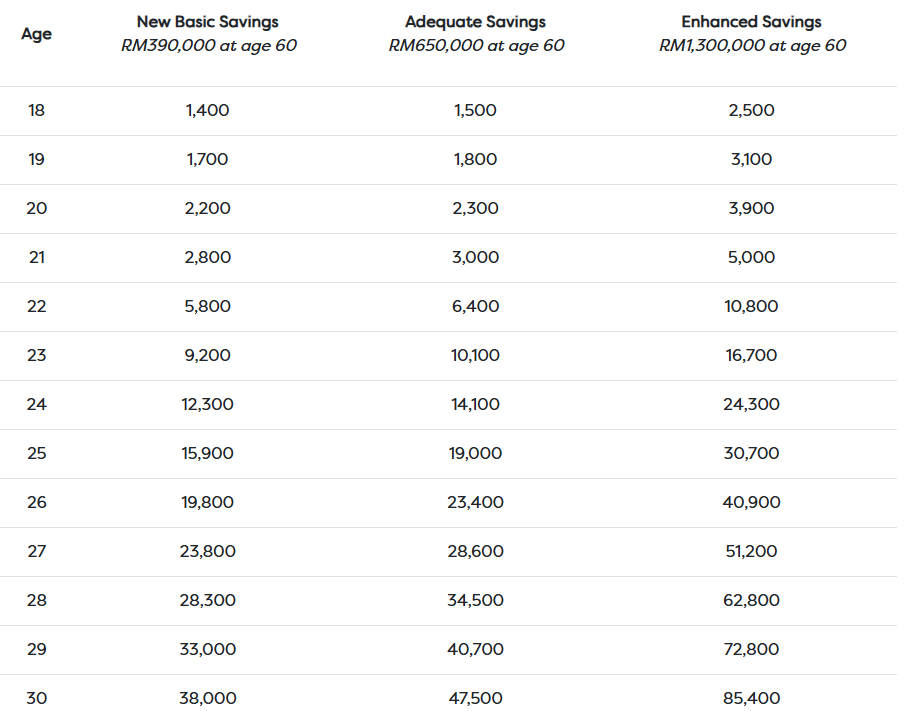

Image credits: KWSP

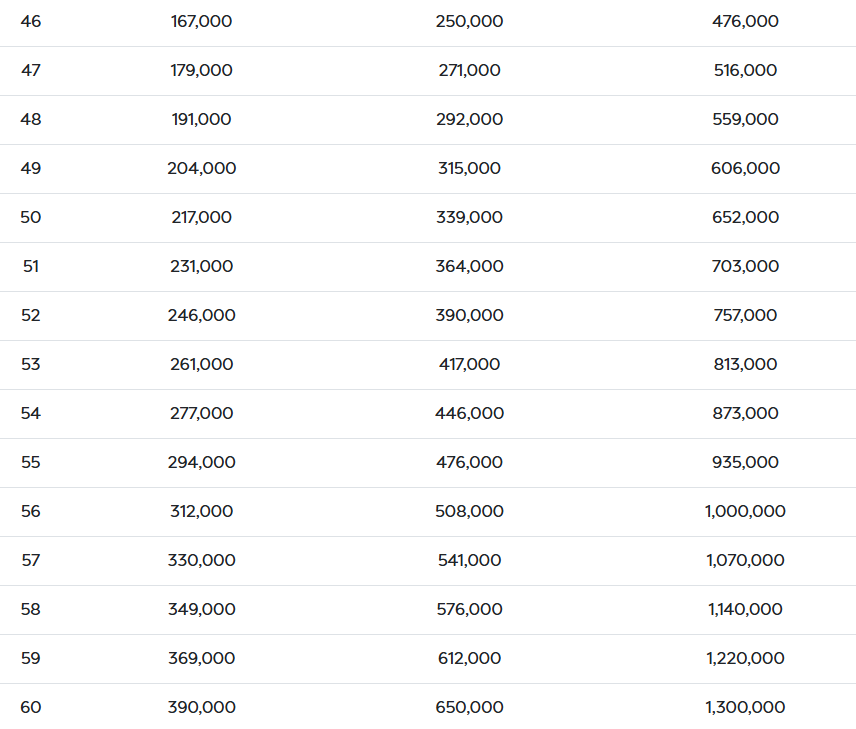

For context, “Basic Savings” is a benchmark amount set by EPF to make sure members have at least RM240,000 by 55. That would roughly translate to a monthly withdrawal of RM1,000 for 20 years, enough to cover essential living costs until age 75.

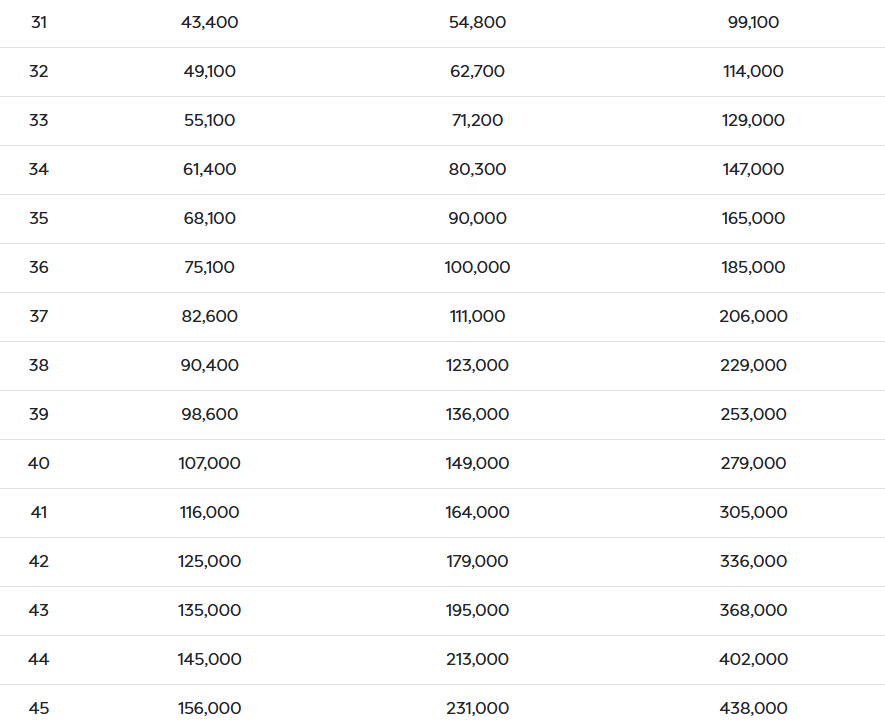

Image credits: KWSP

Image credits: EPF

Average balances already ahead of target

EPF data also shows that savings among members aged 50 to 54 have grown from RM265,788 in 2022 to RM308,644 in 2024 already exceeding the Basic Savings target projected for 2026.

The fund credits this improvement to stronger retirement policies and a rising awareness among Malaysians about the need to save more.

“The upward trend in savings reflects both the government’s continuous efforts to strengthen EPF policies and members’ willingness to make additional contributions,” EPF said.

As Malaysians live longer than ever, the message is clear: the more you save now, the more financial independence you’ll enjoy later.

Follow Wah Piang for more updates.